TECHNICAL DESCRIPTION

The

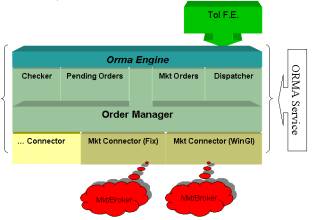

service (OrmaService) has no user interface, can be installed autonomously

in the host system and has been designed taking into account the most

advanced techniques of safety and reliability. System main features are:

-

"confirmation" of actual delivery and receipt of orders by the broker or by the Market through an "Activity Log" mechanism.

-

Orders forwarding in load balancing mode (among several OrmaService installed on various machines)

-

Direct and automatic synchronization of multiple OrmaService processes available on the same network for reallocation of activity loads from the machine at fault.

Structure

BASIC FEATURES

From a functional point of view Orma offers the following basic features:

-

Orders transmission from Bank or Italian Investment Firms' information system according to standard SIA tracking (Finestway), or through extremely semplified exclusive messages;

-

Completely autonomous data base for the management of the automatic orders transmission according to market of trading, security type, counterparty, volumes, frequency, etc;

-

Automatic determination of comunication protocol according to the market of trading/counteparty (ex. Fix, api, WinGI, Finestway Sia, proprietor protocols linked to different brokers);

-

Load balancing system for massive order transmission;

-

Independent management transmission of stop loss, take profit orders;

-

Independent management of uncovered orders with automatic coverage (only for institutional clients)

-

Discrecionary orders management;

-

Monitoring of orders sent to the Market and progress status control;

-

Automatic reception of Market informative reports: suspended securities, etc ( for italian markets);

-

Automatic reception of Market results with automatic switching to the order sender;

-

Ability to manage multi-banks settings without having to split the servers;

-

Ability of "cluster" deployment for management of high volumes of orders.

Briefly, we can say that Orma is a completely independent sub-system (black box) able to route orders to both italian and foreign financial Markets, highly simplifying interfacing and impact on the existing information system.

Parameter customisation

OrmaClient has a user interface which allows customisation of OrmaService's working parameters and display of the orders' dashboard; particularly OrmaMonitor allows:

-

Census of the Markets with their peculiarities and their phases

-

Brokers census

-

Census and scheduling of the times during which are performed the operations of batch verification of data sent and received from OrmaService

-

Display of orders processed in a given time frame and market results.

-

Forced transmission of an order to the Market.

-

Generation of a "NON- EXECUTION" of an unsent order to the Market

-

Other activities of data base and parameters maintenance

Orma: the advantages

The main advantages of Orma system as compared to third party products can be summarized in the following features:

-

Automatic and integrated management of discrecionary orders

-

Integrated management of orders coming from the Market

-

Real time connection with Market information for Stop Orders and Suspended Orders management.

-

Functioning with load balancing on a server's battery

-

Daily reconciliation procedures of Market events in order to ensure full consistency of local data base

-

Automated and integrated closing procedures on orders forwarded to the Market.